Question Number 73872 by azizullah last updated on 16/Nov/19

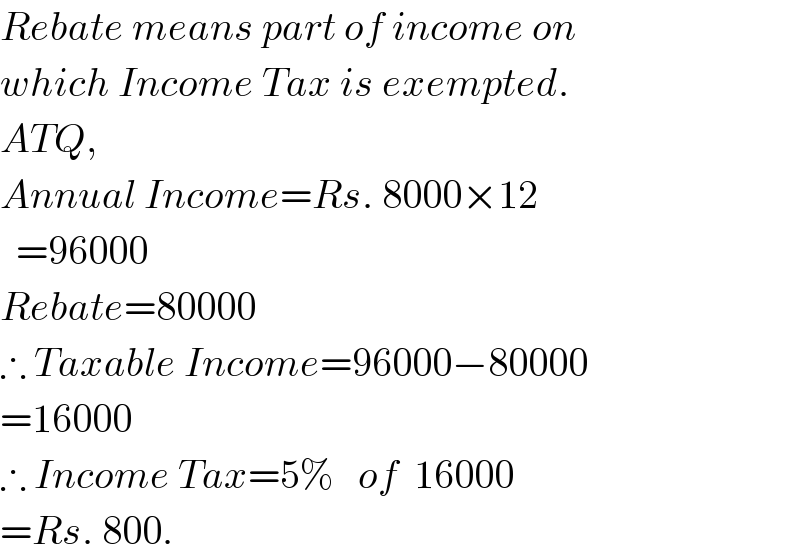

Answered by $@ty@m123 last updated on 16/Nov/19

$${Rebate}\:{means}\:{part}\:{of}\:{income}\:{on} \\ $$$${which}\:{Income}\:{Tax}\:{is}\:{exempted}. \\ $$$${ATQ}, \\ $$$${Annual}\:{Income}={Rs}.\:\mathrm{8000}×\mathrm{12} \\ $$$$\:\:=\mathrm{96000} \\ $$$${Rebate}=\mathrm{80000} \\ $$$$\therefore\:{Taxable}\:{Income}=\mathrm{96000}−\mathrm{80000} \\ $$$$=\mathrm{16000} \\ $$$$\therefore\:{Income}\:{Tax}=\mathrm{5\%}\:\:\:{of}\:\:\mathrm{16000} \\ $$$$={Rs}.\:\mathrm{800}. \\ $$

Commented by azizullah last updated on 16/Nov/19

$$\:\:\:\:\:\:\:\:\boldsymbol{\mathrm{A}}\:\boldsymbol{\mathrm{bundle}}\:\boldsymbol{\mathrm{of}}\:\boldsymbol{\mathrm{thanks}}\:\boldsymbol{\mathrm{sir}} \\ $$